Explore crucial metrics in this blog, unveiling the top 15 for the SaaS industry.

Grasping the essentials: Metrics and Key Performance Indicators (KPIs) are vital for effective decision-making. Before delving into finance, let’s clarify these foundational concepts.

Navigating the SaaS financial landscape: Metrics in SaaS quantify aspects of an organization’s performance. From user growth to profitability, these metrics offer a comprehensive view of a SaaS company’s fiscal health.

MRR measures the predictable revenue generated by subscription-based services on a monthly basis.

MRR = Sum of Monthly Subscription Revenue

CAC calculates the expenses associated with acquiring a new customer, aiding in assessing marketing and sales efficiency.

CAC = Total Cost of Sales and Marketing / Number of New Customers Acquired

Churn Rate identifies the percentage of customers who discontinue their subscriptions, crucial for understanding customer retention.

Churn Rate = (Number of Customers Lost in a Period / Total Customers at the Start of the Period) x 100

CLTV estimates the total revenue a business expects to earn from a customer throughout their entire relationship.

CLTV = Average Revenue Per User (ARPU) x Average Customer Lifespan

Gross Margin assesses the profitability of services by deducting the cost of goods sold from revenue.

Gross Margin = (Total Revenue – Cost of Goods Sold) / Total Revenue x 100

NPS gauges customer satisfaction and loyalty based on their likelihood to recommend the SaaS product.

NPS = % of Promoters – % of Detractors

Conversion Rate evaluates the effectiveness of converting leads into paying customers.

Conversion Rate = (Number of Conversions / Total Leads) x 100

ARPU measures the average revenue generated per user, providing insights into customer value.

ARPU = Total Revenue / Number of Users

Burn Rate calculates the rate at which a SaaS company uses its capital, indicating its runway before needing additional funding.

Burn Rate = (Beginning Cash – Ending Cash) / Number of Months

CCC evaluates the time it takes to convert invested resources into cash inflows.

CCC = Days Sales Outstanding (DSO) + Days Inventory Outstanding (DIO) – Days Payable Outstanding (DPO)

ACV represents the average annual value of a customer contract, aiding in revenue forecasting.

ACV = Total Contract Value / Number of Years in the Contract

Quick Ratio assesses a company’s liquidity and ability to cover short-term liabilities.

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

Customer Retention Cost calculates the expenses associated with retaining existing customers.

Customer Retention Cost = Total Expenses on Customer Retention / Number of Customers Retained

Expansion MRR tracks the additional monthly revenue generated from existing customers through upsells or expansions.

Expansion MRR = New Monthly Revenue from Upsells or Expansions

FCF measures the cash generated by the business that is available for distribution to investors or reinvestment.

FCF = Net Cash from Operating Activities – Capital Expenditures

Customizing Metrics for SaaS Success: Every SaaS company is distinct. Uncover the strategy of choosing and adapting financial metrics that align with your specific goals and industry demands. Whether you’re a SaaS professional, consultant, or investor, this section offers practical insights to enhance your approach.

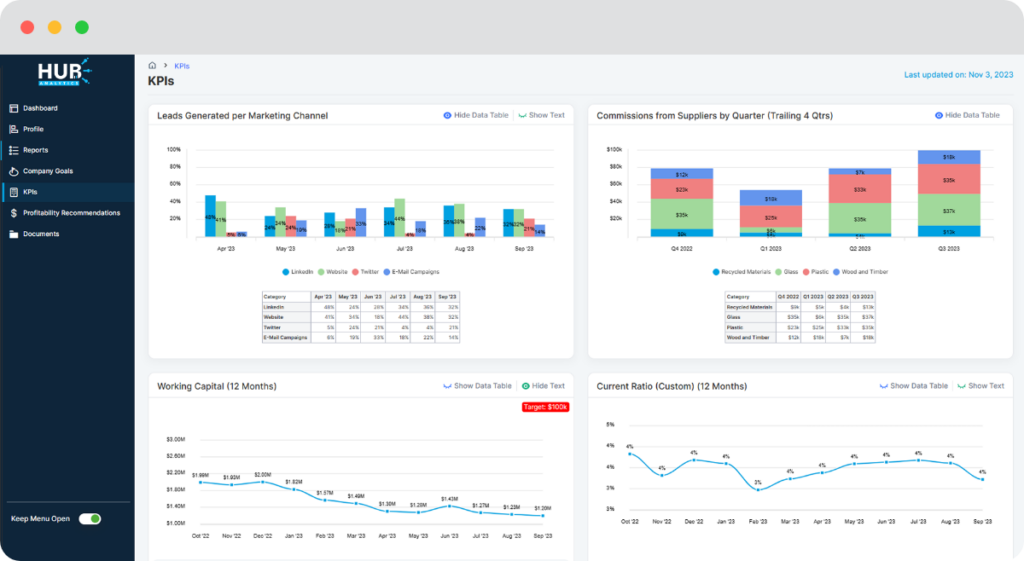

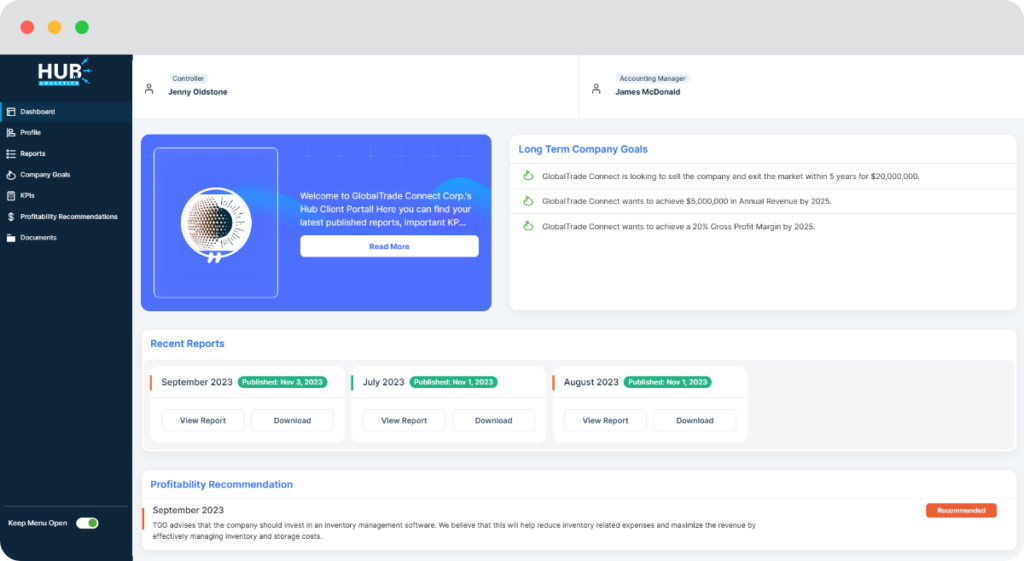

Ready to elevate your SaaS financial strategy? Start tracking essential metrics with HUB today. Optimize performance, gain valuable insights, and make informed decisions for lasting success. Your financial journey begins here.